The federal government does not allow businesses that sell cannabis to deduct ordinary and necessary expenses incurred to run their businesses from their taxable income. This means that a cannabis business cannot deduct:

⇒ Depreciation

⇒ Interest

⇒ Rent

⇒ Repairs

⇒ Salaries and wages.

This is the result of the Controlled Substances Act (CSA), which still classifies cannabis as a Schedule I drug that does not have an approved medical use in the US. This remains the case even in states where the sale of marijuana has been legalized for medicinal purposes.

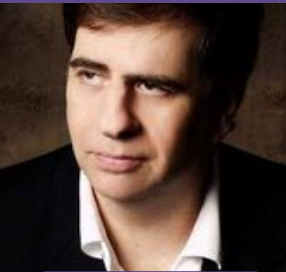

Fulton is a wonderful CPA who fully understands tax law and provides honest advice for his clients.