What U.S. Expats Should Know About The FEIE

FAS CPA & Consultants

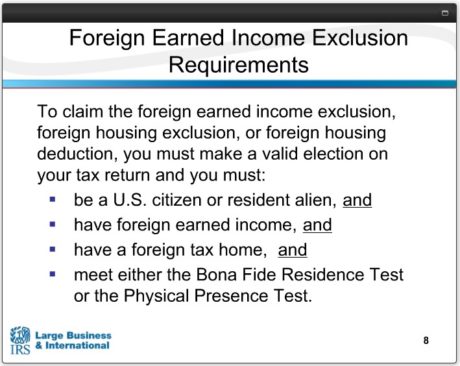

To claim the foreign earned income exclusion, the foreign housing exclusion, or the foreign housing deduction, you must have foreign earned income, your tax sum must be in a foreign country and you must be one of the following: A U.S. resident alien who is a citizen or national — who is a bone fide resident:

⇒ A U.S. citizen who is a bone fide resident of a foreign country or countries for uninterrupted period that includes an entire tax year, a U.S. resident alien who is a citizen or national with country with which the U.S. has an income tax treaty in effect and who is also a bone fide resident of a foreign country or countries for an uninterrupted period that includes an entire tax year, or a U.S. citizen or U.S. resident alien who is physically present in a foreign country or countries for at least 330 full days during any period of 12 consecutive months.

The foreign earned income exclusion is voluntary. You can choose the foreign earned income exclusion, the foreign housing exclusion, or both, by completing the appropriate part of Form 2555. Your initial part of the exclusions on Form 2555 or Form 2555-EZ generally must be made with a timely filed return, including any extensions for the due day, a return amending a timely filed return, or a late filed return filed within one year from the original due date of the return determined without regard to any extension.

You can choose the exclusion on a return filed after the periods we just discussed provided you owe no federal income tax after taking the exclusion into account. However, if you owe federal income tax after taking the exclusion into account, you can still choose the exclusion on a return filed after the periods we discussed before, provided you file before the IRS and you failed to choose the exclusion. You must type or legibly print at the top of the first page of your Form 1040 that is filed for pursuant to Section 1.911-7(ea)(2)(i)(d), and the information about this is also in the instructions of the Form 2555.

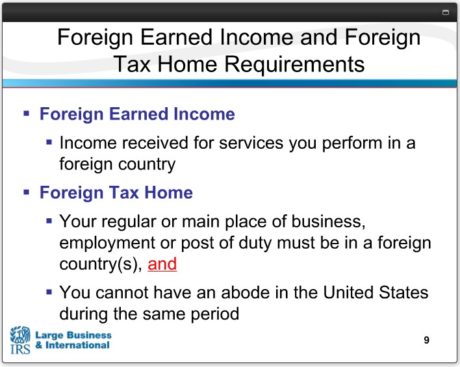

To claim the foreign earned income exclusion, the housing exclusion, or the housing deduction, you must have foreign earned income. Foreign earned income is generally pay you receive for personal services or work that you perform in a foreign country, such as wages, salaries, or professional fees. Now, foreign earned income does not include certain items.

⇒ It doesn’t include the value of meals and lodging that you exclude from your income because they were furnished for the convenience of your employer.

⇒ It doesn’t include pension or annuity payments you receive, including social security benefits. If you receive pay as a U.S. government employee, the pay you receive as a government employee is not eligible for the foreign earned income exclusion.

⇒ You also can’t exclude amounts you include in your income because of your employer’s contributions to a nonexempt employee trust or to a nonqualified annuity contract, or any unallowable moving expense deductions that you choose to recapture, and you cannot exclude payments you receive after the end of the tax year following the tax year in which you performed the services that earned the income.

You must also have a foreign tax home. Your tax home is the general area of your main place of business, employment, or post to duty regardless of where you maintain your family home. Your tax home is the place where you are permanently or definitely engaged to work as an employee or self-employed individual. Having a tax home in a given location does not necessarily mean that the given location is your residence or domicile for tax purposes. Now, if you don’t have a regular main place of business because of the nature of your work, your tax home may be the place where you regularly live. If you have neither a regular or main place of business, nor a place where you regularly live, you’re considered an itinerant, and your tax home is wherever you work. Now there is one condition. You are not considered to have a tax home in a foreign country for any period in which your abode is in the United States.

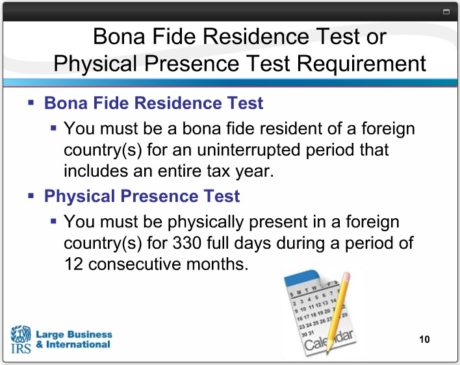

So, in addition to having foreign income and a foreign tax home, you must also meet the bona fide residence test or the physical presence test. You meet the bona fide residence test if you are a bona fide resident of a foreign country or countries for an uninterrupted period that includes an entire tax year. You do not automatically acquire bona fide residence status merely by living in a foreign country or countries for a year or more. If you go to a foreign country to work on a particular job for a specified period of time, you ordinarily will not be regarded as a bona fide resident of that country, even though you worked there for one tax year longer. The length of your stay and the nature of your job are only two of the factors to be considered in determining whether or not you meet the bona fide residence test. You meet the physical presence test if you are physically present in a foreign country or countries for 330 full days during a period of 12 consecutive months. A full day is a period of 24 consecutive hours beginning at midnight. The 330 days do not have to be consecutive.

You can count days that you spent abroad for any reason. You don’t have to be in the foreign country only for employment purposes. You can be on vacation. Unlike the tax home test, this test does not depend on the kind of residence you establish, your intentions about returning to the U.S., or the nature and purpose of your stay abroad.

If you meet the qualifications for the foreign earned income exclusion, you must file U.S. income tax returns, even if you have no tax liability after claiming the exclusion. You must attach either Form 2555 or 2555-EZ to your U.S. income tax return to claim the foreign earned income exclusion.

If you are claiming either the foreign housing exclusion or the foreign housing deduction, you cannot file the Form 2555-EZ. You have to file the Form 2555. Form 2555 shows you how you qualify for the bone fide residence test or physical presence test, how much of your earned income is excluded, and how to figure the amount of your allowable housing exclusion or deduction. Form 2555-EZ is a simpler version of the form that has fewer lines. You can use this form if all seven of the following requirements are met:

⇒ First, you have to be a U.S. citizen or resident alien.

⇒ Next, your total foreign earned income for the year is not more than the maximum foreign earned income exclusion for the corresponding tax year.

⇒ You must have earned wages or salaries in a foreign country.

⇒ You must be filing a calendar year return that covers a full 12-month period. You cannot have any self-employment income for the year.

⇒ You cannot claim any business or moving expenses for the year, and you’re not going to be claiming the foreign housing exclusion or deduction.

So if you meet those, you can file the 2555-EZ, otherwise you need to file the Form 2555.

The maximum foreign earned income exclusion is adjusted annually for inflation. For 2016, the maximum exclusion amount has increased to “$101,300.” You cannot exclude more than the smaller of “$101,300” or your foreign earned income for the tax year minus your foreign housing exclusion amount. If both you and your spouse work abroad and both of you individually meet the requirements for claiming the foreign earned income exclusion, you can each choose the foreign earned income exclusion. If this is the case, both you and your spouse must each file a separate Form 2555 or 2555-EZ. So in other words, if you’re filing a joint return and both you and your spouse qualify for the foreign earned income exclusion, you will have two Form 2555 attached and two $101,300 amounts.

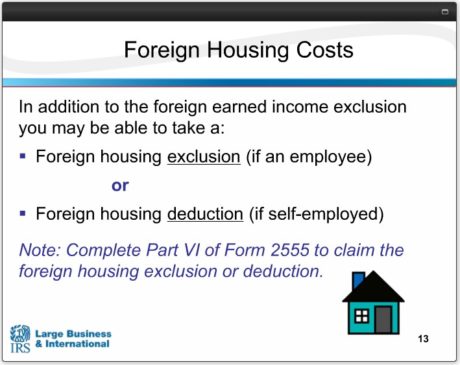

In addition to the foreign earned income exclusion, you can also claim an exclusion or deduction from gross income for your housing amount if your tax home is in a foreign country and you qualify for the exclusions and deductions under either the bona fide residence test or the physical presence test. The housing exclusion applies only to amounts considered paid for with employer-provided funds, which includes any amount paid to you or paid or incurred on your behalf by your employer that are taxable foreign earned income to you for that year without regard to the foreign earned income exclusion. The housing deduction applies only to amounts paid for with self-employment earnings. So if you’re not self-employed you can’t take the foreign housing deduction. Housing expenses include your reasonable expenses actually paid or incurred for housing in a foreign country for you, and if they lived with you, your spouse and dependents. Consider only housing expenses for the part of the year that you qualify for the foreign earned income exclusion when calculating the exclusion or deductions for foreign housing cost.

Click Here To Chat Directly With Our CPA. Make Your Consultation

Being on Foreign Soil for less than a full Tax Year

In the event that you have been in a foreign country for a portion of the year and do not meet the minimum days for the physical presence test or the requirements of the residency test, you would need to consider which of the following options would best fit your situation when submitting your return:

⇒ If you paid foreign income tax, and the rate of taxation is higher or equal to the US tax rates for your income, you can claim the foreign tax credit to offset your US tax liability. It is recommended that you get a tax professional’s advice on this first as claiming a foreign tax credit without IRS approval may negate your claim to FEIE for a period of up to five years hence.

⇒ You could file your tax return without the exclusion and then ask for a review of the exclusion for that year on a pro-rated basis when your bona fide residency or physical presence qualifying period is reached in the year that follows.

⇒ In the instance where three months at the end of a year are spent overseas, and there is a reasonable expectation to be there for the first nine months of the following year, making it a full year on foreign soil, you can fill out an IRS Form 4868 and, if necessary, the applicable state return filing extension request that applies to automatic extensions to October 15th. This creates enough time to meet the requirements of the physical presence test, being 12 months. At that point in time the previous year’s return can be filed with a claim for a partial exclusion for the time spent in that foreign country during the filing year.

⇒ Another alternative is to apply for further extension beyond October 15th on the Form 2350. This will afford you the opportunity to qualify under either set of test criteria, and give you an additional 30 days to file the return for the year to which the pro-rated exclusion claim applies.

All of these options have different consequences so it may be best to get the advice of a seasoned tax professional. It may be worth your while to wait to file a return for a full and partial year if you are deemed to be owing a substantial sum on the original year and be able to recover the amount on an amended return, which you can then do on one return submission.

How To Claim The Foreign Tax Credit (FTC) and Foreign Earned Income Exclusion (FEIE)

Many U.S. citizens who live and work abroad often feel confused about the options they have when it comes to saving money on taxes. The two most common approaches are Foreign Tax Credit and Foreign Earned Tax Exclusion, however the qualifying rules for each are many and sometimes not-so-easy to understand. In today’s article we will try to answer one of the most popular questions asked by people in our Facebook Group US Expats Tax Intelligence “Can I Claim Foreign Tax Credit and Foreign Earned Income?” and give more detailed explanation on the requirements.

Check Our Service: Tax Planning For U.S. Expats

Foreign Tax Credit (FTC)

Foreign Tax Credit can be claimed if you have income that you earn outside of the United States and you also pay income taxes in your country of residence. You can still claim even if you don’t personally earn income abroad but your spouse does and you file jointly. However, there are more requirements you need to cover if you want to claim FTC.

Are you legally liable to pay taxes?

For you to be able to claim FTC, you should have earned income abroad and accrued taxes, for which you are liable in the country of residence. An example of that would be any tax that is taken out of your wages.

Did you pay actual foreign taxes for which you were liable?

This may sound like a very confusing question. Essentially it means that if you are claiming FTC, the amount you declared as foreign taxes paid to the tax authority in the country of residence is the real amount and you are not expecting refunds. If you receive a refund on the foreign taxes you paid, you wouldn’t be able to get a Foreign Tax Credit.

Did you pay income tax or tax in lieu in your country of residence?

First of all let’s clarify what is tax in lieu. It’s taxes you pay on your:

⇒ Gross income.

⇒ Gross receipts or sales.

⇒ Products or exported units.

⇒ Any VAT that you pay is not tax in lieu.

If you have answered “no” to question number 3, then unfortunately you cannot claim Foreign Tax Credit. For more information and details on that, please refer to Publication 1116.

Did you claim the Foreign Earned Income Exclusion (FEIE) or Foreign Housing Exclusion?

You can’t claim FTC in conjunction with FEIE or Foreign Housing Exclusion. In addition, you need to know that even if you qualified on all other requirements and you haven’t claimed either of these exclusions your FTC can still be limited. By the rule, your Foreign Tax Credit can’t be more than your total taxable U.S. income. Therefore, even if the taxes you paid abroad are more than your total U.S. taxable income you wouldn’t get a refund from the States, however, you carry over any excess amount to future years.

Foreign Earned Income Exclusion (FEIE)

FEIE is another method introduced by the IRS to avoid double taxation. It is generally meant for self-employed individuals who live and work abroad. FEIE does not exempt you from your Social Security tax liability. Tax credits can do that. With the new tax reform, it would be much more beneficial for expats to claim FTC than FEIE, since they can’t be received together. Here’s why:

FEIE:

⇒ There’s quite a lot of uncertainty to the exact changes that are coming with the tax reform.

⇒ Earnings under $100,000 a year qualify for FEIE.

⇒ Adjusted annually.

FTC:

⇒ Some countries have higher taxes than the U.S., especially after the tax reform.

⇒ Foreign Tax Credits will be worth more because the they can be used upon the taxpayer’s return to the U.S.

Readers should note that this article is only intended to convey general information on these issues and that FAS CPA & Consultants (FAS) in no way intends for the contents of this article to be construed as accounting, business, financial, investment, legal, tax, or other professional advice or services. This article cannot serve as a substitute for such professional services or advice. Any decision or action that may affect the reader’s business should not rely solely on the contents of this article, but should rather be consulted on with a qualified professional adviser. FAS shall not be responsible for any loss sustained by any person who relies on this presentation. This article is subject to change at any time and for any reason.

Check The Video Version Tax Planning For U.S. Expats

We Are Just A Message Away From You. Get A Consultation

Accounting Firm providing Accounting Advisory, Tax Planning and Offshore Strategies to grow your business and protect your assets.

Clients Feedback

Our Clients Reviews

President

Thanks to FAS & CPA Consultants and Fulton Abraham Sanchez, CPA, I was able to resolve a debt of $479,677.71 that I had with the IRS.

Entrepreneur

My experience with FAS CPA & Consultants has been incredible, their professionalism is impeccable. I highly recommend them.

Manager

I highly recommend FAS CPA & Consultants, they are responsible, efficient and very dedicated.

Manager

Our Blog

Latest Articles

How to Get a U.S. Banking License

How To Get A U.S. Banking License Email Us Today Support@fascpaconsultants.com and Get An Offshore Strategy Review I Want...

Fulton is a wonderful CPA who fully understands tax law and provides honest advice for his clients.